- Videos ·

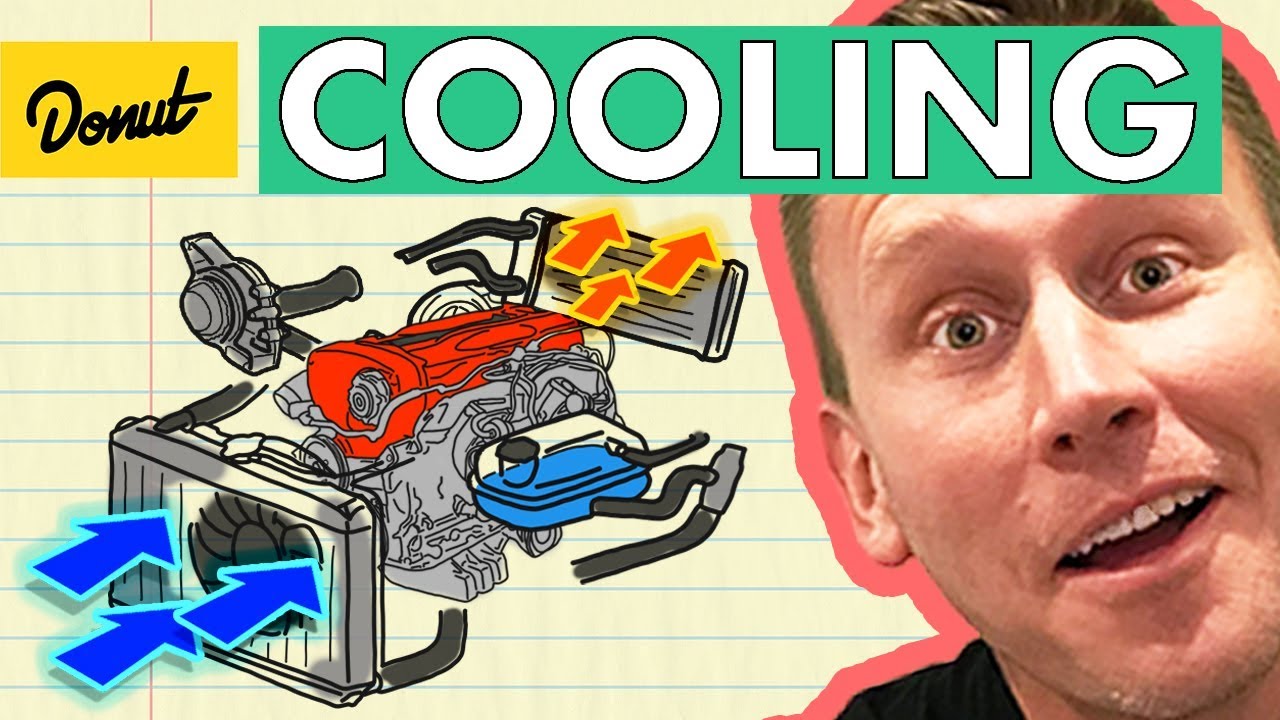

We are North America’s only recruitment firm 100% dedicated to the placement of Diesel Mechanics, related trade professionals and the companies who employ them. In business since 1988, we have developed that largest network of qualified mechanics to be found anywhere!

Call today to find out how we can help find mechanics to support your operation.

Did you know Mechanics Hub facilitates the hiring of more Diesel Mechanics than any company in the world? Our staffing specialists screen and qualify thousands of mechanics for our clients every year. They are extensively trained to give them the knowledge to expertly screen for qualified mechanics. Experience the refreshing difference working with recruiters who know this trade and the industries who employ them.

Did you know Mechanics Hub facilitates the hiring of more Diesel Mechanics than any company in the world? Our staffing specialists screen and qualify thousands of mechanics for our clients every year. They are extensively trained to give them the knowledge to expertly screen for qualified mechanics. Experience the refreshing difference working with recruiters who know this trade and the industries who employ them.

Check out hundreds of mechanic jobs and related opportunities across North America with new ones posted daily. All Mechanics Hub positions are full time, direct hire opportunities typically perks and full benefits. Each position offers enhanced “live toll free support” where you can instantly speak with one of our recruitment specialists about any position or one you may be looking for. Our recruiters have direct access to the decision makers so why not let us help stream line your employment process, keeping you informed and updated along the way? Our number one goal is to get you enhanced employment opportunities and make the process as smooth and hassle free as possible.

Browse through our archives containing hundreds of mechanic related content to amuse, entertain and educate yourself on industry, equipment and trade related topics.

Looking for qualified diesel mechanics? Look no further than Mechanics Hub! Our job board is now open for companies to post their diesel mechanic and related job openings. Sign up now and start posting your job openings today!

Mechanics Hub and Diagonstic Hub are pleased to bring you certified Diesel Mechanic on demand training. Get the skills and knowledge to diagnose and repair today’s modern fleets. Both organizational and individual training available at basic, advanced, and expert levels.

Browse through our archives containing hundreds of mechanic related content to amuse, entertain and educate yourself on industry, equipment and trade related topics.

Thousands of happy clients & candidates!

Quick Links

Positions We Recruit

Connect With Us

Toll-Free #: 1-888-620-5111

Local #: 416-620-5111

E-Mail: [email protected]

Headquarters

5409 Eglinton Ave West, Suite 108

Toronto, Ontario

Canada M9C 5K6

© Mechanics Hub Inc. All Rights Reserved

Website Managed By StableWP

Your application has been submitted to the employer successfully.

Twinsburg, OH, United States

©2023 Mechanics Hub Inc.All Rights Reserved